Calculate the Market Value of a Company is a crucial task for businesses, investors, and analysts alike. This guide delves into the intricacies of determining a company’s worth, exploring various methods and factors influencing the valuation process. From defining the concept of market value to examining industry-specific considerations, we’ll unpack the essential components needed for accurate estimations.

Understanding the nuances of company valuation is key to making informed decisions. This detailed analysis will cover the fundamental principles and practical applications of different valuation methods, empowering readers to apply these concepts to real-world scenarios.

Defining Company Valuation

Company valuation is a crucial aspect of finance, investment, and business strategy. It’s the process of determining the economic worth of a company, often used to assess its market value. This process is complex and involves considering a variety of factors that impact the company’s current and future profitability. Understanding these factors is vital for making informed decisions about investment opportunities, mergers and acquisitions, and overall business performance.A company’s market value represents the total worth of its shares as determined by the free market.

This differs from intrinsic value, which attempts to estimate the true, underlying worth of a company based on fundamental analysis. Market value reflects the current perception of the company’s worth, while intrinsic value aims to assess the company’s worth based on its assets, earnings potential, and future prospects. The difference between these values can be significant and is often a key factor in market fluctuations.

Market Value Interpretation

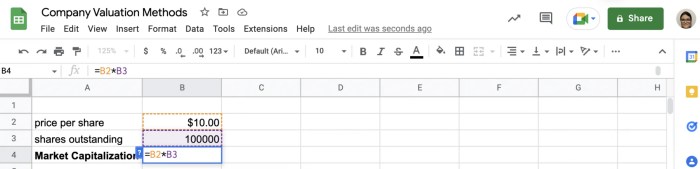

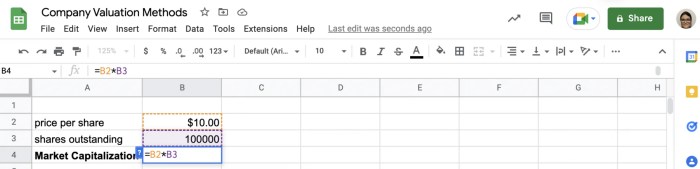

Market value can be interpreted in several ways, each offering a unique perspective on the company’s worth. One common interpretation is the total value of the company’s outstanding shares, calculated by multiplying the current market price per share by the total number of outstanding shares. This represents the aggregate valuation of the company as perceived by investors. Another interpretation focuses on the market capitalization, which provides a broader view of the company’s overall value within the market.

Factors Influencing Market Valuation

Numerous factors influence a company’s market valuation. These factors include the company’s financial performance (revenue, profitability, earnings per share), industry trends, economic conditions, and overall market sentiment. A strong track record of growth, consistent profitability, and positive industry outlook will typically lead to a higher market valuation. Conversely, factors like negative industry trends, economic downturns, or declining revenue will often result in a lower valuation.

Competitor actions, management quality, and regulatory environment also play significant roles.

Valuation Methodologies

Different valuation methodologies exist, each employing distinct approaches to determine a company’s market value. Understanding these methodologies is essential for making well-informed investment decisions.

- Discounted Cash Flow (DCF) Analysis: This method estimates the present value of a company’s future cash flows. It essentially projects the company’s expected future cash flows and discounts them back to their present value, using a discount rate reflecting the risk of the investment. A critical component is the selection of an appropriate discount rate, which reflects the cost of capital for the company and the perceived risk associated with its future cash flows.

An example is valuing a tech startup with significant growth potential but uncertain profitability.

- Comparable Company Analysis (Comps): This approach compares a company to similar publicly traded companies. Analysts assess the key financial metrics of the comparable companies and use these to estimate the value of the target company. This approach leverages the market’s assessment of similar companies, providing a relative valuation benchmark. An example could be evaluating a software company by comparing it to other software companies with similar revenue streams and market share.

- Precedent Transactions Analysis (Precedent Transactions): This method evaluates the value of a company based on the prices paid in recent acquisitions or mergers of similar companies. It relies on the principle of comparability, utilizing the transactions of similar companies to determine the value of the target company. An example might involve valuing a retail company based on the purchase prices of other retail companies with similar characteristics.

| Valuation Method | Description | Strengths | Weaknesses |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Estimates present value of future cash flows | Considers future profitability, provides intrinsic value | Requires accurate projections, sensitive to discount rate assumptions |

| Comparable Company Analysis (Comps) | Compares target company to similar publicly traded companies | Leverages market data, relatively straightforward | Requires finding truly comparable companies, may not capture unique aspects |

| Precedent Transactions Analysis (Precedent Transactions) | Evaluates value based on recent acquisition prices | Provides market-based value, considers control premiums | Limited data availability, potential for outliers, specific circumstances may affect transaction values |

Methods for Calculating Market Value

Determining a company’s worth is crucial for investors, analysts, and the company itself. Various methods exist, each with its own strengths and weaknesses. Understanding these methods allows for a comprehensive assessment of a company’s financial health and potential. This exploration delves into the common techniques used to calculate market value, offering practical insights and examples.

Common Valuation Methods

Several methods are commonly employed to ascertain a company’s market value. These approaches differ in their underlying assumptions and the data they require, making each suitable for specific circumstances.

- Comparable Company Analysis: This method evaluates a company’s worth by comparing it to similar publicly traded companies. It leverages the market’s perception of comparable firms to estimate the target company’s intrinsic value. The fundamental principle is that similar companies should trade at similar valuations, given comparable financial characteristics. This method is relatively quick and straightforward, relying on readily available market data.

- Precedent Transactions Analysis: This technique assesses a company’s value based on the prices paid in previous acquisitions or mergers of similar companies. It reflects the market’s assessment of the target company’s value in actual transactions. This method provides a more direct measure of market value but relies on finding suitable comparable transactions.

- Discounted Cash Flow (DCF) Analysis: This approach calculates a company’s intrinsic value by discounting its future cash flows to their present value. The core idea is that the value of a company is the sum of the present values of all future cash flows. This method focuses on the company’s future profitability and growth potential, making it a more comprehensive assessment. It’s often considered the most rigorous approach, but it heavily relies on accurate forecasts.

Comparable Company Analysis, Calculate the Market Value of a Company

This method involves identifying publicly traded companies with similar characteristics to the target company. Key financial ratios, such as price-to-earnings (P/E), price-to-book (P/B), and enterprise value to EBITDA (EV/EBITDA), are compared. A key strength of this method is its reliance on market-derived data. However, finding truly comparable companies can be challenging, and discrepancies in financial structures or operating strategies can lead to inaccurate assessments.

| Step | Description |

|---|---|

| 1 | Identify comparable companies. |

| 2 | Collect financial data for comparable companies. |

| 3 | Calculate relevant financial ratios for each company. |

| 4 | Analyze the distribution of the ratios and determine a range of values. |

| 5 | Estimate the target company’s value based on the comparable companies’ valuations. |

Discounted Cash Flow (DCF) Analysis

The DCF model calculates the present value of a company’s future cash flows. A simplified DCF model assumes a constant growth rate for future cash flows.

Value = [Cash Flow1 / (1 + Discount Rate) 1] + [Cash Flow 2 / (1 + Discount Rate) 2] + …

This formula discounts each future cash flow to its present value, using a discount rate that reflects the risk of the investment. For example, consider a hypothetical company projected to generate $100,000 in cash flow in year 1, $110,000 in year 2, and $121,000 in year 3, with a discount rate of 10%.

Value = [$100,000 / (1 + 0.1)1] + [$110,000 / (1 + 0.1) 2] + [$121,000 / (1 + 0.1) 3]

This calculation yields a present value of approximately $285,000. A crucial aspect of DCF is accurately forecasting future cash flows and selecting an appropriate discount rate. A company’s growth rate and risk level are critical factors in determining this discount rate.

Data Requirements for Valuation

Accurate company valuation hinges on reliable and comprehensive data. This data encompasses not only financial statements but also external market factors. Understanding these elements is crucial for creating a precise valuation model and making informed investment decisions.

Essential Data Points

A robust valuation process requires a multitude of data points. Key financial information includes historical revenue, profitability (profits and losses), and cash flow statements. These figures provide insight into the company’s operational efficiency and potential for future growth. Further details like debt levels, assets, and liabilities offer a complete picture of the company’s financial health and its capacity to manage obligations.

Finally, market-specific data, including industry trends and competitor analysis, helps contextualize the company’s performance and future prospects.

Obtaining and Verifying Financial Data

Gathering reliable financial data is a critical step. Start by obtaining official financial statements, such as the income statement, balance sheet, and cash flow statement, directly from the company or through publicly accessible sources like SEC filings. Verification is paramount. Cross-referencing data from different sources, like industry reports or news articles, is crucial for ensuring accuracy. Scrutinize the methodology used in preparing financial statements and look for potential inconsistencies.

Reviewing independent audits and reports adds further credibility to the financial data. A thorough review and comparison of the company’s financial data with industry averages helps validate the figures and identify any significant deviations.

Role of Market Trends and Economic Indicators

External factors, including market trends and economic indicators, heavily influence company valuations. Consider the broader economic climate. A booming economy typically translates to higher valuations, while a recessionary environment often leads to lower valuations. Industry-specific trends, like advancements in technology or shifts in consumer preferences, also impact a company’s worth. Thorough analysis of these factors is critical in accurately assessing the company’s future potential and its relative position in the market.

Consider how trends will impact future revenue streams.

Sources for Financial Data

Several sources provide financial data for valuation purposes. Publicly traded companies often publish their financial statements on the company website or via regulatory filings (like SEC filings). Private company valuations often rely on industry databases or specialized financial research services. Market research reports from reputable firms offer invaluable insight into industry trends, competitor analysis, and market forecasts.

News articles, financial news outlets, and economic data aggregators can also provide relevant insights into the economic climate and market trends.

Data Validation Methodology

| Data

Figuring out the market value of a company can be a complex process, involving various factors like revenue, assets, and market share. Just like assessing if you’re ready for a serious relationship, Know if You Are Ready for a Relationship , understanding your own financial situation and resources is crucial before diving into the investment. Ultimately, calculating a company’s market value is about understanding its worth in the broader market context.

Type | Source | Validation Method ||—|—|—|| Revenue | Company financial statements | Compare to industry averages, look for unusual jumps/drops. Cross-reference with market research reports. || Profitability | Company financial statements | Assess consistency over time, examine trends, and look for potential irregularities. || Cash Flow | Company financial statements | Analyze cash inflows and outflows, compare to industry peers, and look for potential issues.

|| Debt Levels | Company financial statements, credit rating agencies | Compare to industry averages, check for unusual changes, and analyze debt service coverage ratios. || Market Trends | Industry reports, news articles | Evaluate the consistency of reports, examine multiple sources, and check for conflicting information. || Economic Indicators | Government agencies, financial news outlets | Cross-reference data from different sources, check for potential biases, and examine the methodology used for calculating the indicators.

Figuring out the market value of a company can be tricky, involving various factors like revenue, assets, and debt. It’s a fascinating calculation, but sometimes, a little musical escape is needed. For example, to truly appreciate the intricacies of market valuation, you might want to listen to an unreleased version of Elliott Smith’s “Angeles” listen to an unreleased version of elliott smiths angeles – it’s a profound exploration of the delicate balance that exists, mirroring the intricate aspects of determining a company’s worth.

Ultimately, understanding market valuation comes down to a blend of meticulous analysis and a touch of artistic appreciation.

|

Factors Affecting Market Value

Determining a company’s market value is a complex process, influenced by a multitude of internal and external factors. Understanding these influences is crucial for accurate valuation and informed investment decisions. A comprehensive analysis considers both the tangible aspects of the business and the intangible elements that contribute to its future potential. This section delves into the key external factors shaping a company’s worth.

Calculating a company’s market value is a fascinating process, involving various factors like revenue, profit margins, and future projections. It’s all quite intricate, isn’t it? Speaking of intricate, I’m really looking forward to the release of the gargantuan Miles Davis box set due soon, gargantuan miles davis box set due. The sheer size and depth of the collection will likely influence its market value, just as strong fundamentals would in a company’s valuation.

So, next time you’re trying to calculate the market value of a company, remember to consider all the moving parts!

External Factors Influencing Market Value

External factors play a significant role in shaping a company’s market value. These factors often shift unpredictably, necessitating continuous monitoring and adaptation in valuation methodologies. The dynamics of the external environment can either boost or hinder a company’s financial performance and future prospects.

Industry Trends and Regulatory Changes

Industry trends and regulatory changes have a substantial impact on a company’s market value. Favorable industry trends, such as increasing demand for a particular product or service, can lead to a higher valuation. Conversely, negative trends, like technological disruptions or shifting consumer preferences, can significantly reduce a company’s worth. Similarly, regulatory changes, such as new environmental regulations or tax laws, can affect a company’s profitability and operational efficiency, thereby influencing its market value.

For example, the rise of electric vehicles (EVs) has increased the market value of companies involved in battery technology and EV manufacturing. Conversely, stricter emission regulations have impacted the valuation of traditional automotive companies.

Macroeconomic Factors

Macroeconomic factors exert a profound influence on a company’s market value. Economic downturns, characterized by decreased consumer spending and reduced investment, can lead to lower valuations. Conversely, periods of economic growth and prosperity generally result in higher market valuations. Interest rates, inflation, and currency fluctuations also significantly affect a company’s valuation. For example, during periods of high inflation, the market value of companies with significant debt can decrease due to increased borrowing costs.

Conversely, companies with strong cash flow positions tend to perform better during these periods. The COVID-19 pandemic, with its associated lockdowns and economic uncertainty, illustrates how macroeconomic factors can dramatically impact company valuations.

Competitive Landscape

The competitive landscape plays a crucial role in shaping a company’s market value. Companies operating in highly competitive industries often face downward pressure on their valuations. Conversely, companies with strong market positions and competitive advantages tend to have higher valuations. Factors such as brand recognition, product differentiation, and distribution networks contribute to a company’s competitive edge and, subsequently, its market value.

For example, the success of a tech startup with a unique product in a competitive market might be valued significantly higher than a similar startup without distinct competitive advantages.

Management Quality and Future Prospects

The quality of a company’s management and its future prospects are critical factors influencing market value. Strong leadership with a proven track record of success can significantly boost a company’s valuation. Similarly, positive future prospects, such as anticipated growth in revenue or market share, tend to increase a company’s market value. A company with a clear vision and strategic plan for future development is typically valued higher than one without a clear roadmap.

For instance, a company with innovative research and development activities, coupled with experienced management, is likely to attract higher valuations compared to its competitors with limited future plans.

Considerations for Specific Industries: Calculate The Market Value Of A Company

Valuing a company isn’t a one-size-fits-all process. Different industries present unique challenges and opportunities, impacting how we approach valuation. Understanding these nuances is crucial for accurate assessments. From the volatile tech sector to the regulated healthcare industry, specific characteristics and regulations significantly influence the methods used and the resulting market value.Industry-specific factors like competitive landscapes, regulatory environments, and growth prospects play a critical role in determining a company’s worth.

These considerations require a deeper understanding beyond the basic valuation methods, demanding an analysis tailored to the particular industry.

Valuation Challenges in Technology Companies

Technology companies often exhibit rapid growth and unpredictable innovation. This dynamism makes traditional valuation methods less reliable. Intellectual property (IP) valuation, for example, is often complex and subjective, requiring specialized expertise. Assessing the market value of disruptive technologies and the potential for future revenue streams are further complications. The value of a technology company is often significantly tied to its intangible assets, such as patents, trademarks, and brand reputation, which require careful assessment and modeling.

Impact of Industry-Specific Regulations on Valuations

Regulatory environments significantly influence valuations in various sectors. Healthcare, for example, faces stringent regulations impacting pricing and reimbursement models. These regulations can limit profitability and influence the overall market value. Stricter regulations, like those in the financial services sector, can influence capital structure and valuation approaches.

Unique Considerations for Healthcare Companies

Healthcare companies are often subject to stringent regulations concerning pricing, reimbursement, and clinical trials. These factors affect profitability and growth projections, influencing the valuation methods employed. The cost of compliance with regulatory requirements and the potential for liability are also important considerations in valuation.

Contrasting Valuation Approaches for Different Industry Types

Different industries require different valuation approaches. A company in the retail sector, for example, might be valued using discounted cash flow (DCF) analysis and comparable company analysis. In contrast, a technology company might utilize the precedent transactions method or the asset-based approach in addition to DCF. The table below highlights some common valuation approaches for different industry types.

| Industry Type | Common Valuation Approaches |

|---|---|

| Technology | Precedent transactions, DCF, comparable company analysis, asset-based, and option pricing models. |

| Retail | DCF, comparable company analysis, precedent transactions, and sometimes asset-based. |

| Healthcare | DCF, comparable company analysis, precedent transactions, and sometimes asset-based, with significant consideration for regulatory impact and reimbursement models. |

Practical Application and Examples

Putting company valuation theories into practice requires a clear understanding of the methods and their limitations. This section delves into a hypothetical scenario, illustrating the application of different valuation techniques and highlighting the variations in resulting market values. We’ll also analyze a real-world case study to contextualize the concepts discussed.

Hypothetical Company Scenario

Imagine “Tech Solutions Inc.,” a software development company specializing in enterprise resource planning (ERP) systems. They have a strong track record of successful projects, a loyal customer base, and a growing pipeline of potential clients. Their current revenue is $5 million, with a projected growth rate of 15% annually for the next three years. The company employs 50 skilled software engineers and has a stable management team.

The industry average profit margin for similar companies is 10%. This information will be crucial in applying the different valuation methods.

Calculating Market Value Using Different Methods

Several methods can be used to determine the market value of Tech Solutions Inc.

- Discounted Cash Flow (DCF) Method: This method estimates the present value of future cash flows. By projecting the company’s future earnings and discounting them back to the present using an appropriate discount rate, the DCF method provides a robust valuation. For Tech Solutions Inc., we project future earnings based on the projected growth rate and industry profit margin. A discount rate of 12% (reflecting the risk associated with the software industry) is applied.

The resultant market value, derived from these projected future earnings, is expected to be relatively higher than other methods.

- Comparable Company Analysis (Comps): This method involves comparing Tech Solutions Inc. to similar publicly traded companies in the same industry. We identify comparable companies with similar revenue, growth rates, and profit margins. By analyzing the market capitalization of these companies, we derive an estimated market value for Tech Solutions Inc. The market value obtained using this method may vary depending on the chosen comparable companies and the weighting given to each factor.

- Asset-Based Valuation: This method values the company based on the net asset value of its assets, including property, plant, and equipment, and intangible assets like intellectual property. For Tech Solutions Inc., this valuation would likely be significantly lower than the DCF or comparable company methods, since the value of their software development and client contracts aren’t directly captured in the asset value.

The method’s limitations are evident, as it doesn’t fully capture the company’s growth potential or earning power.

Rationale Behind Valuation Differences

The different valuation methods produce varying estimates due to their different underlying assumptions and data considerations. DCF analysis is forward-looking, focusing on future earnings potential. Comps rely on historical data and market sentiment, while asset-based valuation prioritizes current asset values. These differences in approaches lead to variations in the final market value estimates.

Case Study Example: Amazon

Amazon’s valuation has been significantly influenced by its massive market share and rapid growth in e-commerce. Early valuations often relied on comparable company analysis, which would likely be lower than current valuations. However, the growth of its market share and online services resulted in the need for higher valuations using DCF methods. The company’s immense intangible assets (brand recognition and market leadership) contribute significantly to its high valuation, exceeding the value derived from traditional asset-based approaches.

Limitations and Assumptions

Valuing a company is a complex process, fraught with inherent uncertainties. While various methods exist, each approach comes with limitations. Forecasting future performance, a cornerstone of many valuation models, is inherently uncertain. Understanding these limitations and the assumptions underpinning valuation models is crucial for a realistic assessment of a company’s market value. Acknowledging these caveats allows for a more nuanced and accurate interpretation of the results.

Potential Limitations in Market Value Estimations

Several factors can influence the accuracy of market value estimations. Market conditions, economic downturns, and unexpected events can significantly impact a company’s future performance, making predictions inherently uncertain. Availability of reliable data, especially for private companies, can also be a major constraint. Furthermore, the chosen valuation method itself introduces limitations, as different models emphasize different aspects of a company’s financial health.

Uncertainties in Forecasting Future Performance

Predicting future earnings, cash flows, and growth rates is inherently uncertain. External factors, such as economic shifts, regulatory changes, or technological advancements, can disrupt projections. For example, the rise of e-commerce significantly impacted traditional retail businesses, leading to unexpected drops in sales and market value for some companies. Similarly, unforeseen crises, like pandemics, can rapidly alter economic landscapes and necessitate substantial revisions to forecasts.

The further out the forecast extends, the greater the potential for error.

Assumptions in Valuation Models and Their Impact

Valuation models rely on several key assumptions. These include assumptions about future growth rates, discount rates, and the stability of market conditions. The accuracy of the valuation depends critically on the validity of these assumptions. For instance, using a constant discount rate might not reflect changing market interest rates, leading to an inaccurate valuation. Moreover, the assumed growth rate in a particular industry might be overly optimistic or pessimistic, influencing the final market value estimate.

Mitigating Potential Errors in Valuation Processes

Minimizing errors in valuation requires a robust and comprehensive approach. Using multiple valuation methods and comparing the results can provide a more balanced assessment. Sensitivity analysis, which examines how changes in key variables affect the valuation, can help identify areas of potential vulnerability. Gathering diverse data points and employing expert judgment are also essential steps in mitigating potential errors.

Summary of Potential Limitations and Mitigating Strategies

| Potential Limitation | Mitigating Strategy |

|---|---|

| Uncertain future performance projections | Employ multiple valuation methods, conduct sensitivity analysis, consider a range of possible outcomes. |

| Limited data availability, especially for private companies | Utilize comparable company analysis, industry benchmarks, and expert opinion. |

| Inadequate consideration of external factors | Thorough market research, analysis of industry trends, and consideration of potential risks and opportunities. |

| Inherent assumptions in valuation models | Employ multiple models, understand the limitations of each, and use sensitivity analysis to assess the impact of varying assumptions. |

End of Discussion

In conclusion, calculating a company’s market value is a multifaceted process requiring careful consideration of various factors and methods. This guide provided a comprehensive overview, outlining the key steps, data requirements, and industry-specific considerations. By understanding these elements, you can approach company valuation with greater confidence and make more informed decisions.