Can You Venmo Yourself sets the stage for an exploration of a quirky phrase that’s become increasingly popular online. It delves into the literal and metaphorical meanings behind this financial and social trend, analyzing its potential implications, humorous uses, and even its practical applications. We’ll examine the different ways people use this phrase, from genuine expense tracking to playful banter, exploring the nuances of its social context.

Beyond the surface-level humor, this exploration uncovers the hidden layers of social interaction and financial behavior. From the potential for misinterpretation to the surprisingly practical applications, this discussion unravels the complexities of this increasingly common phrase.

Understanding the Phrase “Venmo Yourself”

The phrase “Venmo yourself” has become increasingly popular, particularly in online communities and social media. It’s a playful and often humorous way of expressing a specific action, but its meaning can be nuanced and depends heavily on the context. It’s not a literal financial transaction but a metaphorical representation of a particular social interaction.The literal meaning of “Venmo yourself” refers to transferring money from your own account to your own account using the Venmo app, a mobile payment platform.

This act, while seemingly pointless, is often used to convey a particular intention or emotion in a specific social context. The real meaning isn’t about the money itself but the underlying message.

Literal Meaning and Examples

The literal act of “Venmoing yourself” is an empty transaction, not an actual transfer of funds to yourself. This is because Venmo is a peer-to-peer payment system designed for sending money between different accounts. You’re not actually giving yourself money. However, the phrase’s meaning often extends beyond the literal transaction.Examples of situations where someone might use this phrase include:

- Expressing sarcasm or irony, such as when someone is making a sarcastic comment about a situation where they could easily pay themselves back.

- Creating a humorous or lighthearted post on social media, potentially in response to a humorous situation.

- Highlighting a humorous situation or emphasizing the absurdity of a certain situation.

- Using it as a form of playful self-deprecation, acknowledging that something they did or a situation they are in might seem strange or comical.

Ambiguity and Interpretations

The phrase’s ambiguity stems from its departure from the standard usage of Venmo. The act is not intended for financial gain, and it can be understood as a humorous acknowledgment of the absurdity of the situation. This ambiguity allows for various interpretations based on the context and the speaker’s tone.

Social Context

The social context surrounding “Venmo yourself” is crucial to understanding its meaning. It’s often used in online forums, social media posts, and comments, where humor and irony are common. The phrase’s effectiveness relies on the audience’s shared understanding of online culture, where playful language and sarcasm are frequently employed.

Implied Actions and Intentions

The implied actions and intentions behind “Venmo yourself” often revolve around humor, sarcasm, and irony. It’s a way to playfully comment on a situation, acknowledge a humorous oversight, or express a lighthearted response to a particular event. It implies a desire to create a humorous reaction or highlight the absurdity of a situation, rather than a serious financial transaction.

Exploring the Financial Implications

Venmoing yourself, while seemingly trivial, opens up intriguing possibilities for managing personal finances. This seemingly simple act can be a powerful tool for tracking expenses, budgeting, and even analyzing spending habits. Understanding the financial implications requires exploring how this practice fits into existing financial management strategies.This practice allows for detailed record-keeping of transactions, enabling users to meticulously monitor and control their spending.

It facilitates a clear picture of financial flow, leading to improved budgeting and informed financial decisions. This method offers a nuanced approach to personal finance, bridging the gap between casual spending and strategic financial planning.

Expense Tracking and Budgeting

Venmoing yourself is a highly effective method for tracking expenses. Instead of relying solely on receipts or mental records, individuals can log every transaction, creating a comprehensive record of their spending. This can be particularly useful for those who struggle to remember the specifics of their expenses or for those who wish to meticulously monitor their finances. It can aid in identifying patterns and trends in spending, revealing areas where adjustments to budgeting strategies are necessary.

Comparison to Other Financial Actions

Venmoing oneself shares similarities with other financial practices, such as using budgeting apps or dedicated expense-tracking software. The core benefit lies in the meticulous recording of transactions. The advantage of this method lies in its accessibility and ease of use, potentially making it more user-friendly than traditional methods for many individuals. However, it’s crucial to note that it’s not a replacement for comprehensive financial planning and should be considered as a supplementary tool.

Potential Uses for Financial Tracking

This method provides a flexible approach to financial tracking, applicable to various scenarios. The table below illustrates potential uses, highlighting the scenarios, descriptions, and corresponding financial impacts.

Social and Cultural Context

The phrase “Venmo yourself” transcends its purely financial implications, becoming a social commentary on modern interactions and expectations. Its use reveals much about the cultural values surrounding money, sharing, and social dynamics. The phrase’s ambiguity, often used humorously or ironically, reflects the complexities of these interactions in our current social climate.The phrase’s meaning is often dependent on the context and the social circle in which it’s used.

Understanding these nuanced interpretations is key to comprehending its impact and the different ways it can be employed. Its presence in online discussions and social media showcases the evolving nature of financial interactions and their cultural significance.

Potential Reasons for Use

The use of “Venmo yourself” often stems from a variety of motivations. Humor is a prevalent factor; the phrase can be employed to playfully comment on a situation, often related to perceived unfairness or a shared understanding of financial awkwardness. Irony is another significant driver, allowing users to express subtle critiques of societal norms surrounding money. The phrase’s flexibility allows for sarcasm, amusement, or even a degree of rebellion against expected norms.

It reflects the ease with which online platforms allow for quick and indirect communication.

Different Social Circles

The phrase’s application varies depending on the social circle. In close-knit friend groups, “Venmo yourself” might be a playful jab at a shared experience, like splitting a meal or covering a shared expense. In professional settings, its use would be extremely unusual, and likely interpreted as inappropriate. The tone and context heavily influence how this phrase is received.

In online communities, where anonymity and indirect communication are common, it can serve as a lighthearted commentary or a subtle way of expressing disapproval.

Ever wondered if you could Venmo yourself? It’s a fun thought experiment, especially when you consider the recent news about Lil Wayne and Drake teaming up on a remix of Kanye West’s “All of the Lights” plus Kanye’s upcoming SXSW performance. While that’s definitely a different kind of transaction, it makes you think about the possibilities of digital currency and creative collaborations.

Maybe one day you will Venmo yourself for your own amazing accomplishments. Just kidding, or maybe not?

Social Norms and Expectations, Can You Venmo Yourself

| Social Context | Typical Expectations |

|---|---|

| Casual Friend Groups | Sharing expenses is often implicit. A request for reimbursement is usually straightforward. |

| Professional Settings | Formal methods of expense sharing are preferred. Personal financial transactions are generally avoided. |

| Online Communities | A level of informality and humor is tolerated. However, explicit requests for reimbursements are often considered inappropriate. |

| Family Relationships | Expectations vary widely depending on the family’s norms. Open discussion and agreement are generally preferable. |

The table above illustrates how social norms dictate the expected methods of money transfer. These norms differ greatly depending on the relationship between the individuals involved. The underlying expectation is often for transparency and clear communication, which “Venmo yourself” subverts in a humorous or ironic way. Understanding these nuances is crucial for appropriate social interaction.

Ever wondered if you can Venmo yourself? It’s a fun thought experiment, but probably not practical. Speaking of intriguing projects, did you hear about Trent Reznor and Atticus Ross scoring the new Amy Adams film, The Woman in the Window? This soundtrack is sure to be captivating , just like the concept of sending money to yourself.

Maybe Venmo should add a feature for fictional transactions… Still, can you Venmo yourself? Probably not, but it’s a cool thought.

Potential Misunderstandings and Humor

The phrase “Venmo yourself” has a built-in ambiguity that opens the door for playful misinterpretations. It’s a deceptively simple phrase, which makes it ripe for humorous application. Understanding how the phrase can be misinterpreted and used humorously reveals the nuances of its social and cultural context.The very act of sending money to oneself, while seemingly nonsensical, often sparks curiosity and humor.

This is particularly true in a social media context where the unexpected and the absurd often garner attention.

Potential Misinterpretations

The phrase “Venmo yourself” can be misinterpreted in several ways. Some might think it’s a request to send money to a different account, perhaps a typo or a misunderstanding of the intended recipient. Others might see it as a strange form of self-reward or a sarcastic comment on one’s own financial struggles. The potential for a misunderstanding hinges on the context in which it’s used.

Humor in Application

The humor derived from “Venmo yourself” often stems from its absurdity and the unexpectedness of the action. The phrase can be used to create humorous scenarios in a variety of contexts.

So, can you Venmo yourself? Probably not, but you can decide which Destiny 2 collectors edition destiny 2 collectors editions which one is right for you best fits your needs. Figuring out the right one is like picking the perfect collectible—it all depends on your priorities and how much you want to shell out! Ultimately, the decision is yours, just like how you choose to handle your virtual wallet.

- Self-deprecating humor: A user might “Venmo themselves” as a lighthearted way of acknowledging a financial mishap or a particularly expensive purchase, framing it as an absurd but self-aware joke. This approach often comes across as humorous due to the user’s recognition of the unusual nature of the transaction.

- Sarcasm and Irony: The phrase can be used ironically to express dissatisfaction with a situation. For instance, if someone is complaining about a lack of funds, they might jokingly “Venmo themselves” to highlight the absurdity of the situation. The humor here relies on the juxtaposition of the seemingly frivolous action with the underlying sentiment.

- Situational humor: A user might “Venmo themselves” in a situation where they’re experiencing a financial constraint or a lack of funds. This humorous approach capitalizes on the irony of sending money to oneself when one doesn’t have it.

Examples of Humorous Usage

The humor in using “Venmo yourself” often depends on the context and the user’s tone. Here are a few examples:

- Example 1 (Self-deprecating): “Just bought a new pair of shoes. Might as well Venmo myself for the impulse purchase. #WorthIt #BrokeButHappy”

- Example 2 (Sarcasm): “Ugh, this coffee shop is so expensive. Guess I’ll just Venmo myself for this overpriced latte. #SendHelp”

- Example 3 (Situational): “My bank account is practically empty. Guess I’ll just Venmo myself a few dollars. #DesperateTimesCallForDesperateMeasures”

Humor Scenarios

The table below demonstrates different scenarios where “Venmo yourself” might be used humorously, categorized by the type of humor it evokes.

| Scenario | Humor Type |

|---|---|

| A user is complaining about a high utility bill. | Sarcasm/Irony |

| A user is making a lighthearted joke about overspending. | Self-deprecating |

| A user is in a situation where they are financially constrained. | Situational |

| A user is making a joke about a friend’s extravagance. | Situational/Sarcasm |

Practical Applications and Alternatives

“Venmo yourself” might seem frivolous, but it can have practical applications, especially when tracking expenses and budgeting. Understanding the nuances of this practice, alongside exploring alternatives, allows for a more comprehensive approach to personal finance. This section dives into the specifics of these applications, contrasting them with traditional methods and offering supplementary strategies.

Specific Situations

“Venmo yourself” finds its most practical use in situations where a clear record of spending is needed, but a traditional method might be cumbersome. For instance, if you’re splitting a meal with friends, “Venmo yourself” can create a precise record of the individual costs, without the need for manual calculations or shared receipts. Similarly, if you’re making multiple small purchases throughout the day, “Venmo yourself” can provide a quick snapshot of those expenditures, aiding in budgeting and expense tracking.

This is particularly useful for those who prefer digital record-keeping and find it difficult to meticulously track receipts.

Comparison with Other Transaction Recording Methods

Traditional methods of expense tracking, such as using a physical notebook or a spreadsheet, often require significant time and effort for detailed recording. While useful for a detailed account, they can be tedious for quick snapshots of spending. Venmo, in its self-transactional form, offers a streamlined approach, ideally suited for individuals who prefer digital records and rapid expenditure tracking.

Digital expense tracking apps and software offer comparable advantages in terms of speed and ease of use, though they may vary in features and cost.

Alternative Methods for Tracking Expenses and Budgeting

Beyond “Venmo yourself,” various alternatives exist for tracking expenses and budgeting. These alternatives cater to different preferences and levels of sophistication. Many individuals leverage budgeting apps, which offer features like expense categorization, goal setting, and personalized insights. Other alternatives include spreadsheet software, where users can manually input transactions and create customized reports.

Table of Alternatives to Venmoing Oneself

| Alternative | Advantages | Disadvantages |

|---|---|---|

| Budgeting Apps (e.g., Mint, Personal Capital) | Automated expense tracking, categorization, goal setting, personalized insights, often with linked accounts. | Subscription fees, potential for data privacy concerns, may not be suitable for all levels of complexity. |

| Spreadsheet Software (e.g., Google Sheets, Microsoft Excel) | Highly customizable, allows for detailed analysis, often free or low-cost. | Requires manual input, can be time-consuming for frequent transactions, may lack automated insights. |

| Physical Notebook/Journal | Simple, low-tech, encourages mindful spending, often personalized to user’s needs. | Time-consuming to record every transaction, potentially prone to loss or damage, lacks automation. |

| Accounting Software (e.g., Xero, QuickBooks) | Suitable for businesses and complex transactions, offers detailed reporting and financial analysis, integration with other business tools. | Steeper learning curve, higher cost, often not practical for individual personal finance. |

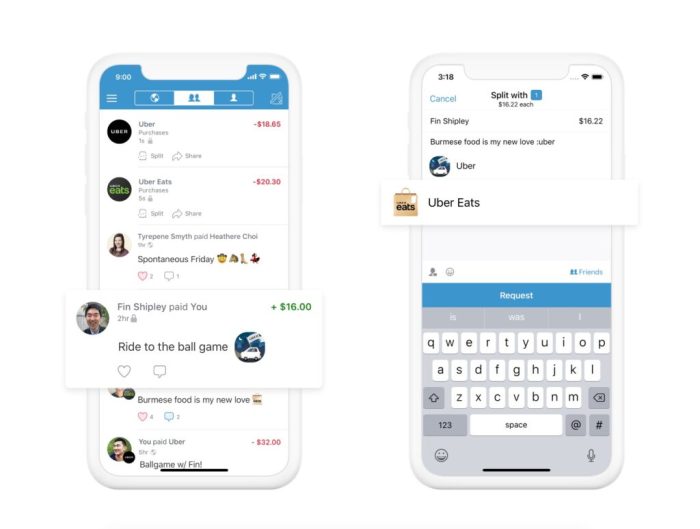

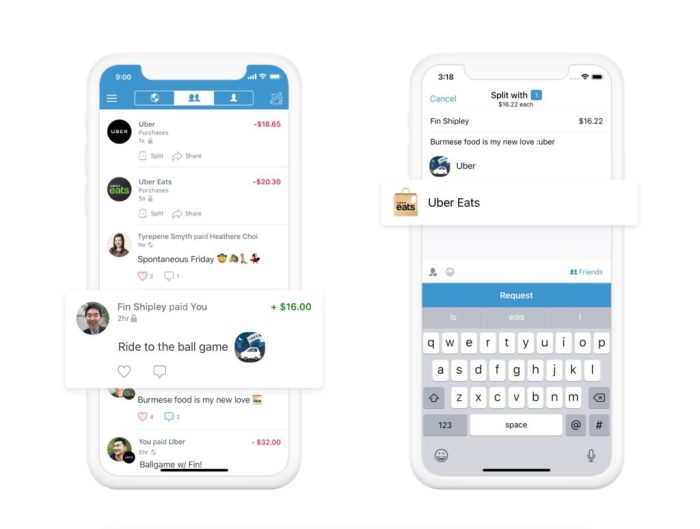

Visual Representation of “Venmo Yourself”: Can You Venmo Yourself

The phrase “Venmo yourself” has taken the internet by storm, prompting a wave of curiosity and humor. Visual representation can further clarify the nuances of this quirky financial concept. Understanding the visual context is key to grasping the implied meaning and potential scenarios.

Visual Design Elements

This visual representation aims to be easily understandable, humorous, and relatable. The color palette will use a blend of light blues and greens, reflecting the Venmo app’s branding and a sense of playful financial transaction. Icons will be crucial in conveying the core idea. A Venmo icon, perhaps stylized with a slightly mischievous grin, will be central.

A small, cartoonish depiction of money, possibly in the form of coins or dollar bills, will subtly represent the financial aspect. The background will be a simple, light-gray gradient, allowing the icons to stand out.

Flowchart of Potential Scenarios

The flowchart will illustrate different scenarios where “Venmo yourself” might be used. The flowchart will begin with a starting point representing the user initiating the transaction. From there, branching pathways will lead to different potential outcomes.

- Scenario 1: The user mistakenly sends money to themselves, resulting in a “double-payment” situation. A small icon of a surprised face with money flying out could be used to represent this. This branch could then show different possible solutions to the user. This could be highlighted by different colors.

- Scenario 2: The user uses “Venmo yourself” to make a fun, symbolic payment to themselves for a task or accomplishment. A checkmark icon next to a small trophy or achievement symbol could illustrate this. This branch will be shown in a different color and possibly a different shape to clearly distinguish it from the previous one.

- Scenario 3: The user “Venmos” themselves to cover a shared expense, but then forgets to Venmo the other person. This could be illustrated by a Venmo icon accompanied by a confused face, or an icon showing a missing or blank field.

Intended Message

The overall visual representation aims to convey the humorous and often nonsensical nature of the phrase “Venmo yourself.” It will highlight the various ways people might use this expression, ranging from unintentional errors to playful self-rewards. The flowchart will also demonstrate the potential misunderstandings and practical applications. By using icons, colors, and a straightforward flowchart, the visual will effectively communicate the meaning of the phrase in a concise and engaging way.

The design should be accessible and understandable for a broad audience.

Conclusive Thoughts

Ultimately, “Venmo yourself” reveals a fascinating interplay between financial practices, social dynamics, and the ever-evolving language of online communication. While initially seeming like a simple financial transaction, the phrase becomes a window into how we track expenses, communicate humor, and navigate the nuances of modern social interaction. Understanding this phrase allows us to better appreciate the complexities of human behavior and the ways in which technology shapes our daily interactions.